How to process payroll and SSP COVID-19 Reclaims

HMRC allow SMEs to reclaim SSP they have paid to employees who are self-isolating because of Coronavirus (COVID-19). You cannot reclaim Statutory Sick Pay (SSP) if your employee is off sick for another reason.

The weekly rate for Statutory Sick Pay (SSP) is £95.85*, subject to HMRC rules. If you’re not using payroll software, you can calculate the SSP you may receive by using HMRC SSP calculator:

HMRC - Calculating Statutory Sick Pay

Using the above example and assuming that the employee is entitled to SSP for 10 days out of 13 working days taken off, the payroll run would look as follows:

Gross Pay = £1,967.50

SSP = £188.50

Total Pay = £2,156

PAYE Tax = £185.17

Employee NI = £149.82

Employer NI = 172.29

Net Pay = £1,821.01

- Therefore, the above Salary Journal would be entered as follows:

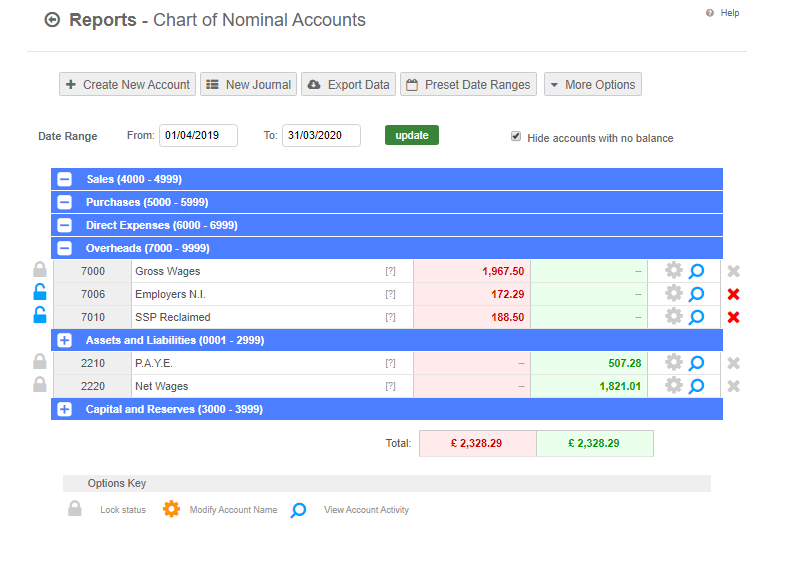

The Chart of Nominal Account shows:

- Enter the following journals If you are reclaiming the SSP from HMRC due to COVID-19:

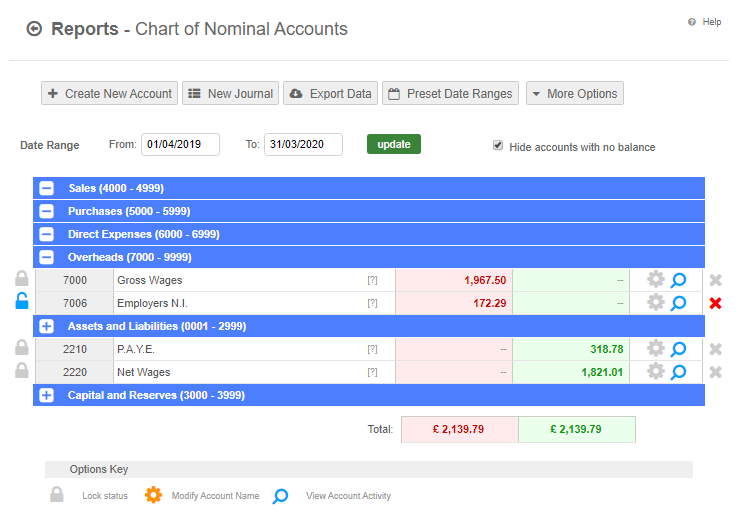

The Chart of Accounts now shows the correct balances and the PAYE/NI liability due to HMRC after reclaiming SSP:

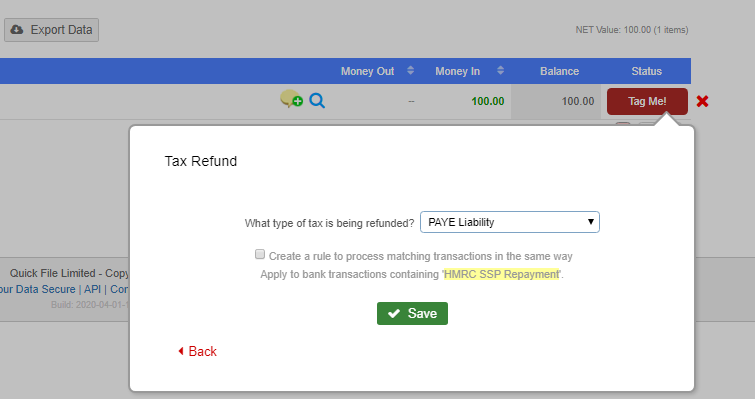

- If you have insufficient PAYE/NI Tax to offset against the total amount of SSP, the repayment balance of funds received into the Bank from HMRC for SSP would be tagged as follows:

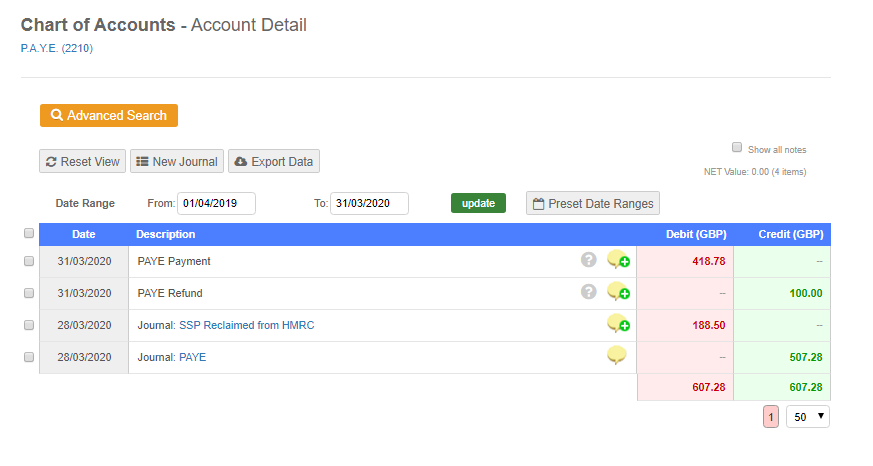

The above scenario is shown in the example below, as you can see the PAYE (2210) account balances to Zero:

- Figures are correct at the time of publication.