Year end checklist forms

Introduction

Checklist items can be applied to any active Workspace as a means of gathering additional information from a client. We’ve put together a number of prebuilt checklist items that will help obtain specific figures from a client to complete their year end accounts. We actually use these forms internally for anyone who signs up to our managed Limited company year-end accounts package.

Here you will find a brief overview of what each form does. These data capture forms do not directly affect the accounting records but provide a way for the client to relay information that can be viewed in the Affinity Workspace area and manually applied later.

Payroll Figures

If a client is managing their Payroll with a third party, they may not be journalling these figures into QuickFile. You can use this data capture form to request the headline figures from their payroll application.

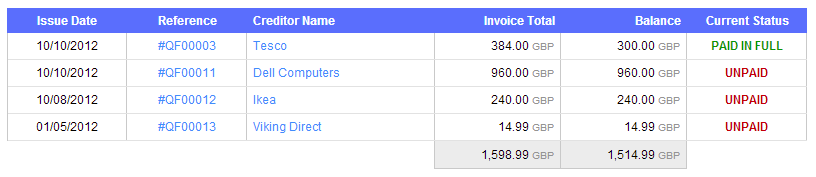

Year-end Creditors

This will reveal a list of outstanding purchase invoices at the close of the accounting period. All your client needs to do is confirm this information is correct.

Year-end Debtors and Bad Debt

This will reveal a list of outstanding sales invoices at the close of the accounting period, including any invoices flagged as bad debt. All your client needs to do is confirm this information is correct.

Stock Balances

This will allow your client to enter the closing stock balance for the end of the accounting period. The opening balance will also be displayed and referenced from the nominal account 1001.

Asset Purchases and Depreciation

This form will show all asset purchases (bound to invoices) made within the accounting period. The client will also be able to nominate those invoices that should be subject to depreciation.

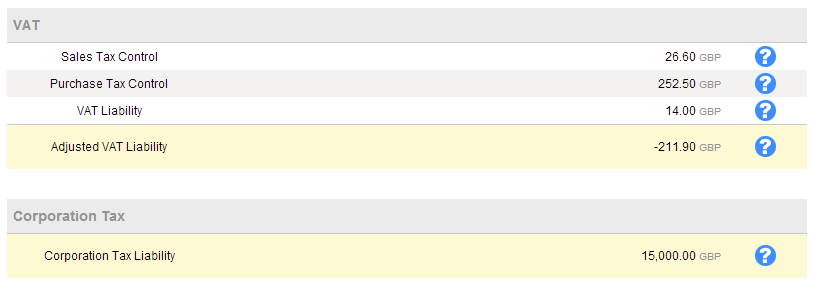

Taxation

This form reveals the opening and closing balances on the VAT and Corporation Tax liability control accounts. It will also show the sales tax and purchase tax totals representing VAT that has not yet been allocated to a VAT return.