Balance Sheet Report

The Balance Sheet report gives you a snapshot of the assets, liabilities and equity for your organisation at a specific point in time. It is a useful financial statement for assessing the value of a company based on what the company owns and owes, as well as the amount invested by shareholders.

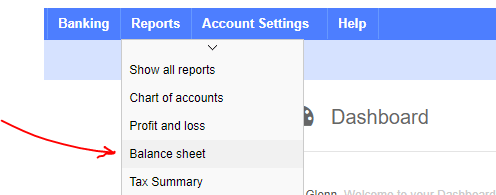

In QuickFile you can locate the balance sheet in the main Reports menu:

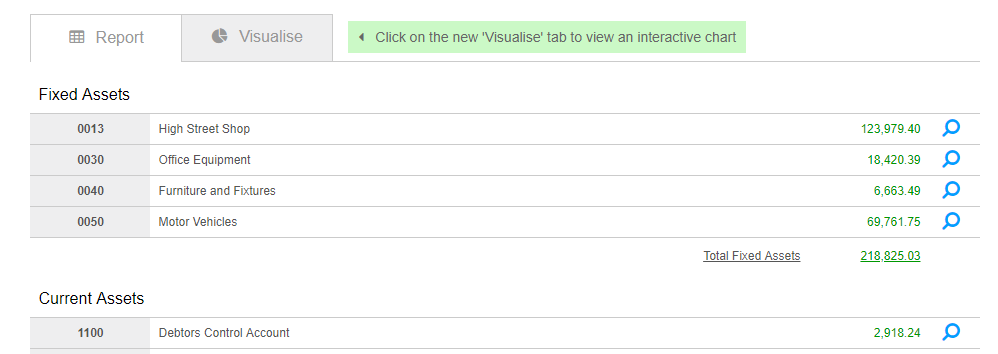

You can then set a date for your balance sheet and see the results in tabular or chart format:

Your balance sheet is divided up into 5 distinct sections.

Fixed Assets

These include the value of items that are not easily liquidated to cash. They can be things like property, land, machinery, motor vehicles, furniture, office equipment, patents and other capital purchases.

Current Assets

These include the value of items that are more easily liquidated to cash, usually a qualifying current asset can be liquidated within 12 months. Current assets include things like bank accounts, debtor control accounts (i.e. value of issued invoices), prepayments, inventory on hand and other cash equivalent items.

Current Liabilities

These are the company’s short term (due within 12 months) debt obligations and include things like credit card balances, overdrafts and creditor control accounts (i.e. unpaid supplier invoices).

Long Term Liabilities

As the name would suggest these are liabilities that would be settled over a longer time period (greater than 12 months). It may include things like mortgages, pension obligations or deferred tax liabilities.

Capital and Reserves

Capital and Reserves will usually show capital introduced into the organisation by its shareholders, retained earnings from previous accounting periods along with the cumulative profit and loss balance for the current period.

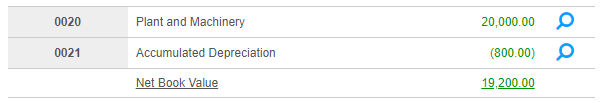

Depreciation

QuickFile will automatically group together depreciation with the corresponding asset nominal code. This will be presented on the balance sheet along with the “Net Book Value”.

Depreciation is automatically supported on a number of system nominal accounts, these include the following:

Plant and Machinery (0020) ------> Plant and Machinery Depreciation (0021)

Office Equipment (0030) -----------> Office Equipment Depreciation (0031)

Furniture and Fixtures (0040) -----> Furniture and Fixtures Depreciation (0041)

Motor Vehicles (0050) --------------> Motor Vehicles Depreciation (0051)

Intangible Assets (0100) -----------> Intangible Assets Amortisation (0101)

Goodwill (0110) -----------------------> Goodwill Amortisation (0111)

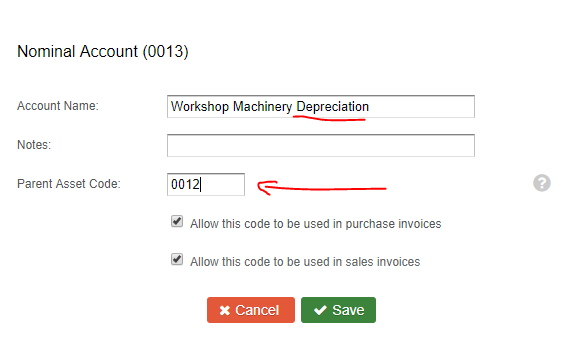

You can also setup custom asset / depreciation pairs from your Chart of Accounts report. When you create a new nominal account in the asset range (1-1999) and include the word “depreciation” in the account name, if you then edit the nominal code (orange cog wheel) an option will be presented to specify the parent asset code to which the depreciation should be set against.