Bookkeeping for Letting Agents

If you are a Letting Agent you may wonder how best to account for the collection of rent and the remittance of the NET payments (less fees) to your landlords. This guide will cover the following points

- Rental income received from the tenants

- The deduction of management fees from the gross rent received.

- The payment of the net balance to your landlords.

Here we will assume the landlord is the client and we will isolate all transactions for a given property to a loan type bank account. This holding account can then work as a statement that can be issued to your landlord showing all relevant movements of money.

The Steps

- First create a client record for each of your landlords.

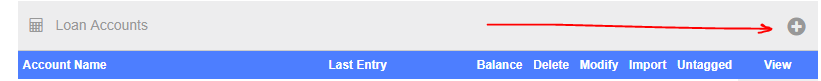

- Now create a loan type account in the banking section for each of your managed properties. This will be used to track the monies received from the tenant and paid out to the landlord. We will refer to this in subsequent steps as the “Property Holding Account”.

- Now tag the tenant income on your bank account as a transfer to the new Property Holding Account created in the previous step.

- Create a sales invoice for the landlord to cover the management fee. This can be setup as a monthly recurring invoice for simplicity.

- Now pay the landlord’s management fee invoice to the Property Holding Account created in step 2.

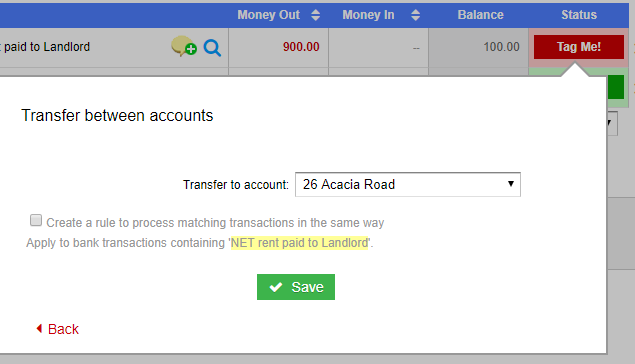

- Once you have transferred the NET sum to the landlord from your bank account, locate the “money out” entry and tag it as a transfer to the Property Holding Account for that particular property.

Final Points

The balance on your business bank account should now match the actual balance remaining in your physical account after all rental income and management fees are accounted for.

The balance on the Property Holding Account created in step 2, should also now NET to zero with 3 entries for the tenant monies received, the management fee and the NET amount transferred to the landlord. This schedule of transactions can also form the basis of a statement that can be issued to the landlord.

If you have any questions about this or any of our bookkeeping guides please don’t hesitate to post your question to the forum and we’ll be happy to assist you.