Categorising your purchases

QuickFile can help you keep track of your business expenses with ease. Sign up for free

Introduction

The basis of any accounting system is the nominal ledger. QuickFile comes preloaded with around 180 nominal ledgers that are used to categorise the day-to-day transactions you make in your business. In QuickFile we refer to these ledgers as Nominal Categories and they feature predominantly in the purchase entry screens.

How to know which nominal category to use for my expenses

Categorising purchases can be tricky if you’re new to bookkeeping, fortunately there are a few simple rules that will keep you on the right track:

-

The category “General Purchases” can cover any item you buy in your business that is either resold or rearranged to form part of your product or service. If you’d rather be more specific you can create an additional nominal account.

-

Items purchased using personal funds do not affect the purchase category, but instead how the payment is recorded. An out of pocket expense for a Sole Trader will be paid from the Proprietor Drawings Account, for Limited Companies it would be paid from Directors’ Loan Account (assuming the director made the purchase).

-

Food purchases should rarely be claimed as a “Business Expense”. Sundry items like tea, coffee, milk etc can go under “Staff Refreshments”. If the food items are resold in your business or constitute ingredients (e.g. catering businesses) you would use “General Purchases”.

-

Agency, accounting, and legal fees go under “Professional Fees”.

-

Practically all items you buy in your business should be recorded as a purchase, whether you do this manually or from Bank Tagging. There are some exceptions however that are not purchases and should be tagged from the bank. These include:

- Tax payments

- Salary payments

- Drawings

- Loan repayments

- Mortgage repayments

- Payments to clear credit cards

-

A number of nominal categories when used would record a purchase as an asset. Common asset purchases include computers, tools (construction businesses), motor vehicles, and furniture. The “Asset” categories when logging a purchase are marked as such in the menu and include the following:

- Furniture and Fixtures

- Motor Vehicles

- Office Equipment

- Plant and Machinery

- Stock

I’m still not sure which category to use, what should I do?

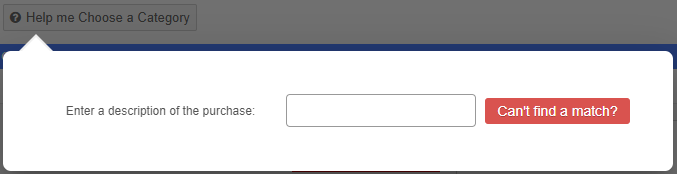

When entering your purchase you will find a button above the line item area “Help me Choose a Category”. This will open the dialogue box that will allow you to search 100s of helpers, that we have added, based on common items.

If you still can’t find what you are looking for you can always make a post on our community forum. Our forum is frequented by accountants and bookkeepers who may be able to assist further.

In most cases one of the existing nominal categories will be suitable for your purchase, but you can also add your own custom accounts if you can’t find a suitable match. Be careful not to add to many nominal accounts as this will create extra work for your accountant, come the year-end.

Can I change the category of previously entered purchases?

Yes, in most cases, you can go back and modify the category of previously entered purchases. If you need to change an incorrect posting on multiple invoices or invoices residing in a locked period you can use the bulk re-coding tool. You can also use a simple journal to move a group of wrongly posted entries.