Choosing the right VAT options for your overseas clients and suppliers

On the 1st January 2021 the UK left the EU customs union and VAT regime. Up until this time you may have become accustomed to applying the EC VAT Reverse Charge option on your sales and purchase invoices to zero the VAT where the criterea allows.

Now the UK has left the EU VAT system there are some subtle changes to the way you invoice and record your purchases for EU based entities.

Please Note: The following is intended as a general guide and we always recommend that you carefully evaluate your client and supplier relationships when determining the eligibility to remove VAT from an invoice.

Sales Invoices

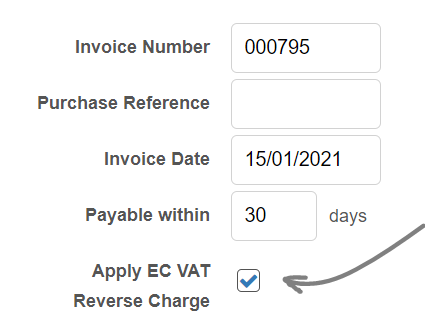

Depending on the Place of Supply Rules your supplies made to EU based customers may become outside the scope of UK VAT. Previously you would use the check box “Apply EC VAT Reverse Charge” as illustrated above.

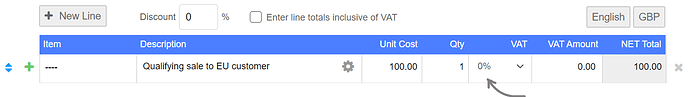

Now where the rules permit (e.g. B2B services) you should instead mark the items on your invoice with the zero rate of VAT. This will ensure that those sales continue to be reported in box 6 of your VAT return, but no output VAT will be reported.

If you are on the Flat Rate VAT scheme and the place of supply rules determine that the supply is outside of the UK VAT area, you can instead use the “out of scope for UK VAT” option, this will ensure that the total of those invoices are not included in your flat rate turnover.

Purchase Invoices

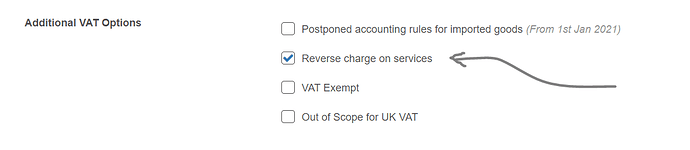

In regards to your purchase invoices you may previously have applied the reverse charge for items received from EU based suppliers. These items can still be reverse charged however the option has now moved further down the invoice editor under “Additional VAT Options”.

When selected this will report the VAT and NET amounts for the invoice on boxes 4 and 7 respectively, it will also reverse the same entries in boxes 1 and 6.

If you’d like to find out more about the Brexit related VAT changes you can take a look at our more detailed guides below:

Brexit Transition VAT Overview

If you have any unanswered questions please don’t hesitate to open a new topic here on our forum.