Client Credit Limits

If you’d like to keep a track on how much credit you’re providing your clients, then the Client Credit Limit feature will allow you to do just that. For each client in your account you can set an advisory credit limit, whenever the client account reaches the limit we’ll let you know.

Setting a Credit Limit

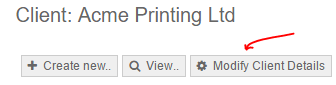

To set a new credit limit simply locate your client and click the **Modify Client Details** button.

In the client settings you will see a box to enter a credit limit, if the box is blank no credit limit will be imposed.

![]()

Any credit limit you assign here will assume the default currency set for this client. If the default currency for your client is USD the limits will only be imposed on invoices denominated in USD currency.

Once saved your credit limit will be active.

Checking the Credit Position

Once a credit limit has been set for a client you will then see the credit limit in the main account balances section within the client preview screen. This will show how much is remaining on the credit limit and will warn you if the credit limit is exceeded.

Issuing Invoices

When a new invoice is drafted for a client that has an assigned credit limit, we will warn you if sending that invoice will result in the credit limit being exceeded.

We will also extend this warning to Estimates so that any new estimate once converted will not exceed the credit limit.

Comparing Credit Limits

Finally you can also see all your assigned client credit limits in the Client Management area. The credit limit column is not visible by default but you can enable this in the advanced settings dialogue box within the Client Management area.