Flat Rate VAT

Introduction

The Flat Rate VAT scheme allows participating businesses to simplify their VAT accounting by only paying a reduced rate of VAT on their total sales without reclaiming VAT on purchases. On the flat rate scheme you simply total up your VAT inclusive sales for a given period and then derive the VAT payable to HMRC using a reduced rate dependent on the activities the business is engaged in.

The basics

The basic criteria for the flat rate scheme is as follows:

- participating businesses pay a reduced rate of VAT on their sales and cannot reclaim VAT on purchases (with a small number of exceptions).

- participants must have a VAT exclusive turnover of GBP 150,000 or less for a rolling 12 month period.

- the agreed flat rate is issued in-line with HMRC’s Flat Rate business categorisation.

Reclaiming on capital assets

Normally you can’t reclaim VAT on the purchases you make while you are on the flat rate scheme. HMRC do however allow you to reclaim VAT on certain capital asset purchases in excess of GBP 2,000. A full list of criteria for making such a reclaim can be found on the link below:

Claiming back VAT on capital assets

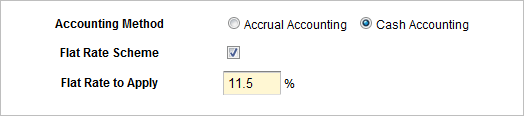

Setting up as a flat rate user on QuickFile

QuickFile offers full support for businesses that are on the flat rate VAT Scheme. To get started all you need to do is head over to the VAT Settings area and tick the box to say that you wish to use the flat rate scheme and then enter the agreed flat rate of VAT.

Inputting your sales and purchases

As far as entering your sales and purchases while on the flat rate scheme, there really isn’t much difference than for ordinary VAT accounting. Here are some things to remember while completing your bookkeeping:

- all sales invoices are entered at the standard rate of VAT (Currently 20%, June 2012) not the flat rate of VAT. This allows your clients to claim back the full VAT that they are entitled to the VAT columns on the purchase entry form are not available and all purchases are entered gross without VAT

- you may override the VAT restriction on purchases by checking the appropriate box, this will allow you to reclaim VAT as necessary (please ensure such purchases qualify for a reclaim)

- all prepayments made by your customers before an invoice is raised are subject to VAT at the flat rate

Changing to or from the flat rate scheme

In QuickFile you can only file a VAT return for a given period using one type of VAT accounting method. You cannot change accounting methods mid-way through a VAT period and if you are already on the flat rate scheme you cannot change the flat rate percentage mid-way through a VAT period. Each return is filed with one accounting method under one rate, this keeps the calculations as simple as possible.

Flat rate adjustments (nominal account 4999)

When on the flat rate scheme you are effectively invoicing at one VAT rate (standard rate) and claiming at another rate (flat rate). This means that when the VAT Return is filed an adjustment needs to be made to your sales tax and general sales to balance the figures.

Example

When we raise an invoice under the flat rate scheme we have the following breakdown on our ledgers:

- £1,000 - General Sales

- £200 - Sales Tax

- £1,200 - Gross Total

When we file the VAT return lets say we have a flat rate of 10%. We will pay GBP 120 to HMRC, therefore using the above example we need to adjust the Sales Tax down by GBP 80 and increase the General Sales by GBP 80. The result looks something like this:

- £1,080 - General Sales

- £120 - Flat Rate @ 10%

- £1,200 - Gross Total

QuickFile takes care of all these adjustments automatically. The additional debit on the sales is made using the nominal account 4999 (flat rate VAT sales adjustment). This will appear when the return is filed and is easily distinguishable from general sales.

Prepayments on the flat rate scheme

When collecting payments from clients without attaching them to an invoice, these payments (prepayments) also form part of your total vatable income and are subject to the flat rate of VAT levied by HMRC. QuickFile will automatically include such payment in your return. It is important to note that QuickFile will not adjust for changes in the flat rate from one VAT period to another, if such prepayments are bound to invoices when a different VAT rate is in effect. Whatever the flat VAT rate is in effect when the next return is filed this will be the only time the prepayment is considered in the VAT calculations.

Additional reading on flat rate VAT

HMRC provide a comprehensive guide on the flat rate VAT scheme. If you’d like to know more about registering for flat rate, accounting rules and how the calculations for boxes 1-9 are made on the return, then please consult the guide below:

You can also find more general guidance on VAT at the Knowledgebase article below