Importing data from another system

Introduction

When migrating to QuickFile from another accounts package you may need to consider how you will bring across the data stored there. This guide will discuss 3 methods for importing data. You can also use our interactive questionnaire here to point you in the right direction.

Unless you have a very new company you don’t want to go back and import every single invoice and bank transaction. Importing Opening Balances is the quickest way to get started on QuickFile. Most accounting application will allow you to produce a Trial Balance (TB) that can easily be imported to QuickFile.

Let’s take a look at some options.

Method 1 : Start using the system from the beginning of your financial year

This method essentially involves entering each individual sales/purchases invoice onto the system one by one, along with the relevant customer/suppliers details. Using this method will allow you to see all the transactions for each individual customer/supplier, along with their individual balances from the start of your financial year. The downside with with method is if you have any significant number of transactions, it will be a slow process.

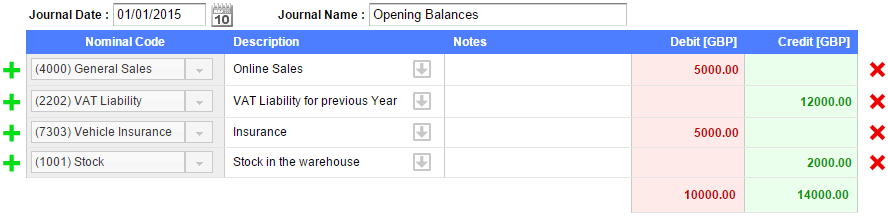

Method 2 : Manually enter your opening balances

If you don’t have a great deal of activity on your previous accounts you could just manually enter your opening balances. This goes in as a single journal with multiple lines. Don’t forget to set the journal date to correspond with the date you started using QuickFile. You can find the manual opening balance entry form in your Account Settings area.

![]()

Method 3 : Import your Trial Balance

This methods involves obtaining the Trial Balance or list of account balances from your existing accounting system and uploading the CSV or entering the figures as at the day before you want to start using QuickFile. We have provided guides for obtaining the Trial Balance from the most common accounting systems; follow the step by step guide below for the relevant link.

Step 1. Decide when you want to start using QuickFile from:

Depending on whether you’re VAT registered we recommend the following start dates:

For non VAT Registered

Unless you’re VAT Registered, you should start using the system from beginning of the month e.g. if you decide to use QuickFile from 1st June 2015 and enter all transactions for sales/purchases onto the system from that date, you will need to obtain your Trial Balance or list of account balances up to the day before, in this example 31 May 2015.

For VAT Registered

We recommend that you start from the beginning of a VAT period for a return yet to be submitted e.g. if your VAT period ends on 31st July 2015, we would recommend that you start entering all invoices on QuickFile from the 1st May 2015. In order to achieve that you will need to obtain your Trial Balance or list of account balances up to the day before, in this example 30th April 2015.

Step 2. Export your Trial Balance to CSV

This is a relatively simple process if you’re using accounting software, simply follow the guide below for your existing accounting system:

Step 3. Importing the CSV Trial Balance into QuickFile

Now that you have your trial balance in CSV format you will need to upload it to QuickFile. From your main Dashboard click the link ‘Account Settings’ in the left hand (vertical) menu.

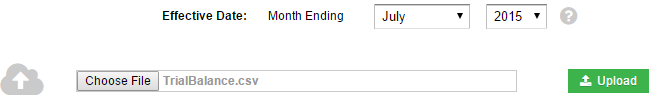

You should see option as shown below:

![]()

Click this link and you will be presented with an upload dialogue box. Select the effective date for the opening balances, this should be at the beginning of your current financial year.

Once the trial balance has been uploaded you will have the option to map the entries to the appropriate nominal ledgers in QuickFile.