Managing credit cards in QuickFile

Introduction

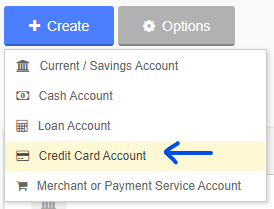

In QuickFile credit cards are treated as a type of bank account. The bank account tracks the balance on the credit card at any given point in time. It's easy to create a new credit card account, all you need to do is go into the Bank Management area and click the blue **Create** button and then select **Credit Card Account**

You will then see a form like the one below where you can enter account name, account credentials, and any opening balance on the card. If you owe money on the credit card then this opening balance must be expressed as a negative amount in the opening balance box.

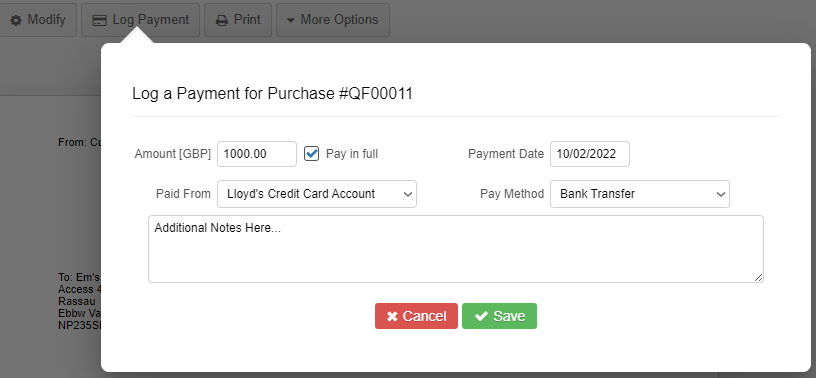

You are now ready to start logging purchase items made against the credit card. You can do this when you log a new purchase by selecting the bank name, in our case ‘Lloyds Credit Card Account’ in the payment

section.

Once you save this item it will add a line to the bank account to reflect the purchase made on the credit card. In our example this is the only purchase in the account but in reality there could be many. The total balance on the account shows the liability on the credit card.

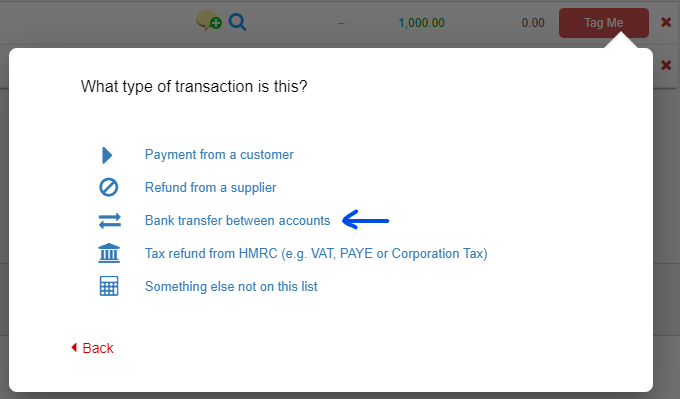

Now a little while later the money leaves the Current Account to pay down the credit card bill. This will appear on your bank statement as an untagged entry when you import your current account statement into

QuickFile.

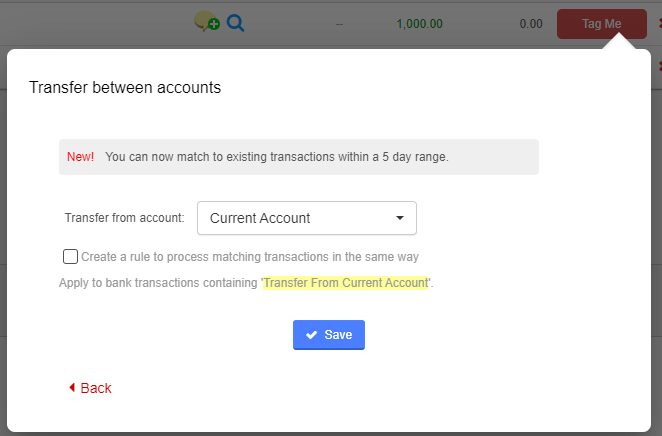

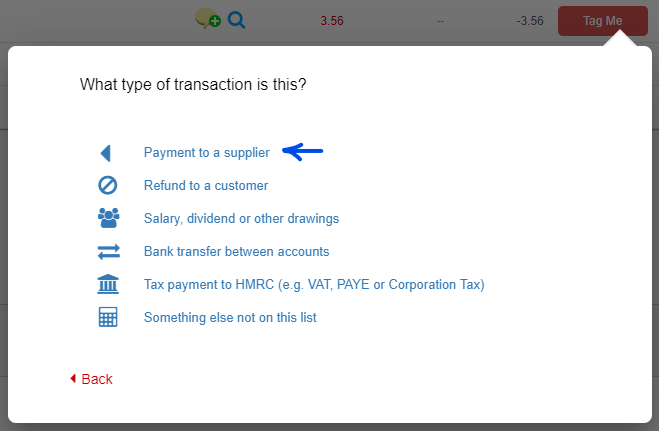

We need to tag this entry as a bank transfer to the Credit Card Account. Click the “Tag Me!” button and select the option “Bank transfer between accounts”. In the next section select your credit card account to transfer the funds over.

The NET effect of these steps will leave a balance of zero in the Credit Card Account. One payment on the credit card (in reality there could be many) and one single payment to reduce the balance.

But what about interest payments?

When you pay interest to a credit card company you need to add this as a "Money Out" transaction on the Credit Card Account. Click to add a new transaction and specify the amount of interest paid for the given billing period.You can now click to tag this payment.

You should tag this as a purchase made with a supplier and tag it to a supplier e.g. “Lloyds Credit Card Charges”. In the category drop down list select the option “Bank Charges”.

Remember there’s no VAT on bank charges.

You can store as many credit cards as you like in QuickFile and this accounting method can also be used for loans and mortgages. The principle is much the same and the liability will be tracked in the company accounts.