Recording payroll

Introduction

A common query that comes up on our forums are in regards to recording payroll. How you record it does depend on your setup, but we'll look at both options below.The 2 ways that payroll can be handled within QuickFile are:

- With a payroll journal

- Without a payroll journal

1. With a payroll journal

The advantage of a payroll journal is that it allows you to record it prior to paying your employees, and it would show as a Liability on your balance sheet report. If you run your own payroll, you can follow the steps below; if you have an accountant who runs it for you, they may be able to help with this.

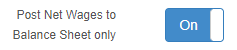

The first thing to ensure is that this option is enabled. You can turn this on by going to Account Settings >> Advanced Settings, and making sure the Post Net Wages to Balance Sheet Only is turned On

What does this do?

When you now record a payment of a salary, it will only post it to the balance sheet. This allows you to create the balancing journal. You would normally create the journal first which would show that the money is owed, and the bank transaction would then balance it out.

The journal

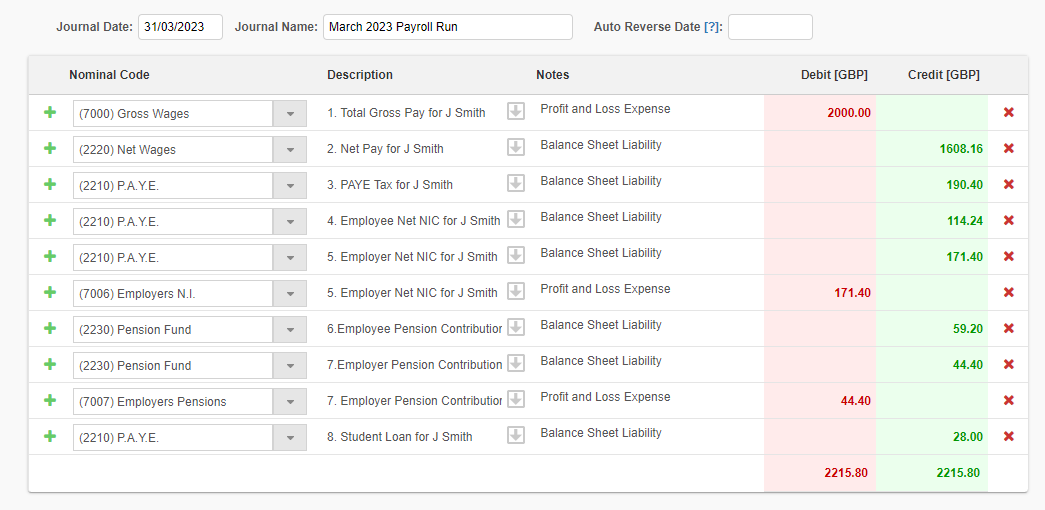

If you are creating the journal manually, you will need to take into account PAYE, Pensions, Student Loan deductions, and the salary or wage itself.

In response to feedback, we have revised the guide so that all HMRC liabilities are now journaled to a single nominal code (2210: P.A.Y.E.). This approach is more practical as it accurately reflects the total amount due to HMRC under one nominal code, without requiring additional journal entries. Furthermore, It should also be noted that the NI balance sheet code (2211: National Insurance) is now only relevant for non-PAYE liabilities (e.g., class 1A).

The journal would normally look something like this:

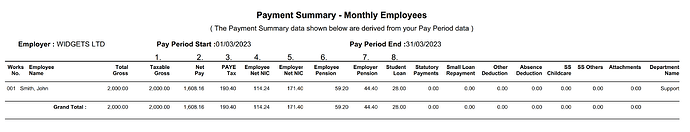

1. Example of a monthly payroll payment summary report:

2. Journals:

To make is easier to follow the example, in the description the prefix number cross references to the figures above report:

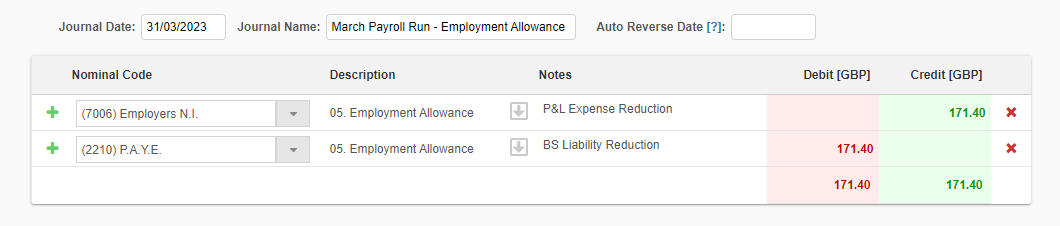

Employment Allowance Journal:

Check:

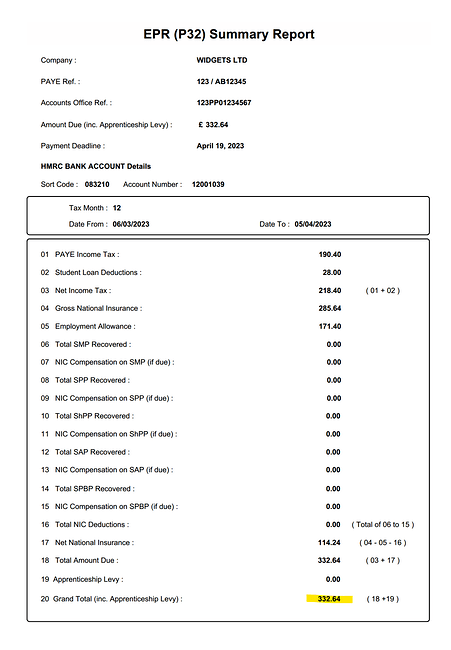

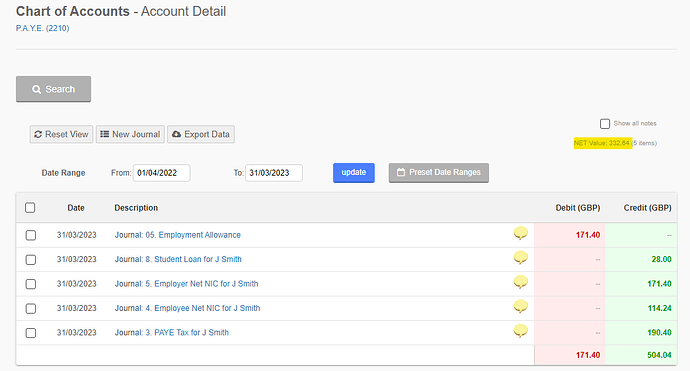

We can see from the payroll EPR (P32) Summary Report, that the total amount due to HMRC is £332.64.

The above PAYE liability is confirmed to the figure on QuickFile:

![]()

The number of lines, and what you enter depends on your own circumstances. For example, if there’s no student loan deductions, then you wouldn’t need to include this.

Where would I get these figures from?

These figures are often calculated by your payroll software. There are many packages available which can help with this. If you were to use The Payroll Site, they can generate this journal automatically for you.

Do I need to show individual payments for each employee?

This is personal preference. There’s no need to show this, as your payroll software would normally be able to give a full breakdown should you ever need to. But you’re welcome to do this within QuickFile if you feel it would help.

What about a director?

If you process a director’s pay as part of your payroll, then the process would be similar. The exception would be instead of using 7000 Gross Wages, you would use 7001 Directors Salaries.

How do I show they’ve been paid?

-

Create a new bank transaction in QuickFile that reflects your bank statement (e.g. if you paid £400.00 wages, then you would have a transaction for £400.00).

-

Click ‘Tag Me!’ and select ‘Salary of other drawings’:

-

Ensure ‘Employee Salary (PAYE)’ is selected, and enter a recipient’s name (if applicable)

-

You’re done! Your balance sheet should no longer show that you owe salaries, and your profit and loss will now reflect this as being paid.

2. Without a payroll journal

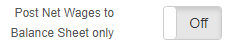

If you’re using QuickFile without payroll journals then you need to first ensure that the ‘Post Net Wages to Balance Sheet only’ option is turned Off. This can be found in Account Settings >> Advanced Settings>>Accounting Tab:

What does this do?

When you tag a payment in your bank account as a salary, QuickFile will do two things for you.

-

It will tag this payment to

2220 Net Wages -

A second posting is made to move it from

2220to7003 Net Staff Salaries Paid

This is a short cut version of the journal, and useful if there are no deductions for example.

F.A.Q.

Is this how Sole Trader wages are tagged too?

Sole Traders aren’t technically employed by their own business. Legally, there’s no separation between them and the business itself. They can however take drawings and put capital into the business. There’s more on this here.

What about a Director’s Loan?

These should be handled using the Director’s Loan account. There’s more on this here