Starling Bank Feed

Who are Starling Bank?

Starling Bank is a mobile-only bank account, available to sole traders, limited companies as well as offering individual and joint bank accounts too. Starling is one of the challenger banks launched in recent years, but unlike some, it has a banking licence and offers FSCS Protection too.

Setup your Starling Bank Feed on QuickFile

Please Note: You will need an active “Automated Bank Feed” subscription (£15 + vat per year) to setup a new Starling bank feed.

-

If you have not done so already go to your bank management area and create a new current account for Starling Bank.

-

Make sure to set the bank name as “Starling Bank” in the drop down list.

-

Once created click to view the bank statement for Starling, then click “More Options” and “Setup a direct feed”.

-

Click on “Connect” to be taken to the Starling Bank authorisation page.

-

You will be prompted for your phone number and your Starling bank account number. Enter these here

-

You will receive a notification on your phone, similar to this one:

Tap the notification to continue. -

A list of permissions will be shown for you to approve or deny. If you tap “Approve”, you will grant access to QuickFile.

-

Finally, you will need to scan a QR as shown on your screen. Full details are given in the Starling app directly.

-

The set up is complete. On QuickFile, you’ll be taken back to your account, where you will see a confirmation message to confirm this is connected.

What transactions are imported, and when?

Unlike our Open Banking feeds, Starling provides us with a live feed. What this means, is rather than waiting for the overnight feed to update your account, we’ll import transactions as they happen, providing they are not pending.

These transactions are sometimes referred to as “booked” or “settled”.

Starling will notify us whenever a transaction takes place or is updated, in a similar way to you receiving the notifications on your phone.

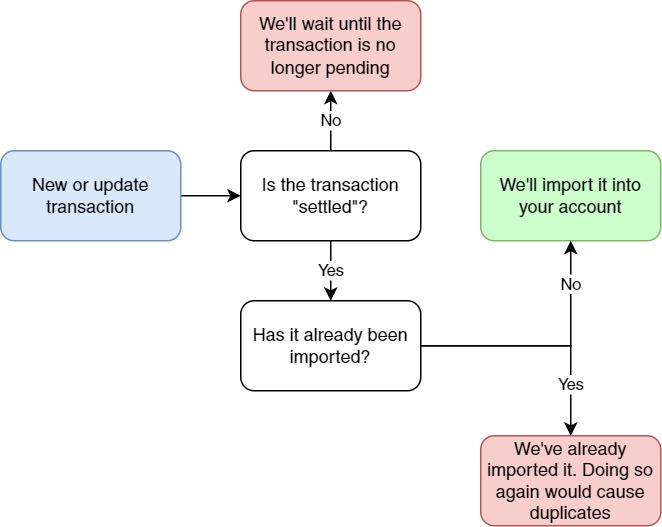

When Starling notifies us of a new transaction, we’ll do a few checks before deciding whether or not it should be imported into your account. The above diagram shows an overview of this process.

Closing Points

Here are a few things to note when connecting your Starling Bank account to QuickFile.

-

The feed will start importing bank transactions from the date the feed was connected. Transactions that take place prior to this will not be imported by the feed but can be imported from a CSV file. To do this, go to the Account Management area of your Starling app and tap on Account Information. Here you can view your statements and export them as .csv.

-

Inline with PSD2 regulations you will be asked to reconfirm your connection to Starling Bank every 90 days. Starling will notify you via the app when you need to do this.

-

QuickFile will only use the necessary API methods to retrieve the bank account and transaction data. It is a read-only integration, no transactions will be initiated with this API.

-

You can revoke access at any time by deleting your feed on QuickFile or by deleting the authorisation from the Starling Bank app.

-

Most transactions will appear in your account in real-time. That is, as they happen on your account, they will appear on your QuickFile bank statement.

-

Some transactions such as card payments will appear after a few hours or even days after taking place. We will only show cleared transactions on your account to match your bank statement (rather than your transaction list in the Starling app).

-

If a reversal or failed charge happens, we will not delete your original transaction, but instead create a new transaction reversing the original, which you can then tag as you wish.

-

You can only link accounts from the same legal entity. For example, you may be able to link several accounts from Starling, providing they’re all owned by the same limited company.