Statement of Cash Flows Report

The Statement of Cash Flows report allows you to analyse cash flowing in and out of your business and identify important cash flow trends. Principally the report will help you to answer the following questions.

- Are you generating a cash surplus or deficit?

- Is cash increasing due to new loans or disposal of investments?

- Is cash decreasing due to the settlement of loans or new investments?

The Cash Flow Statement Explained

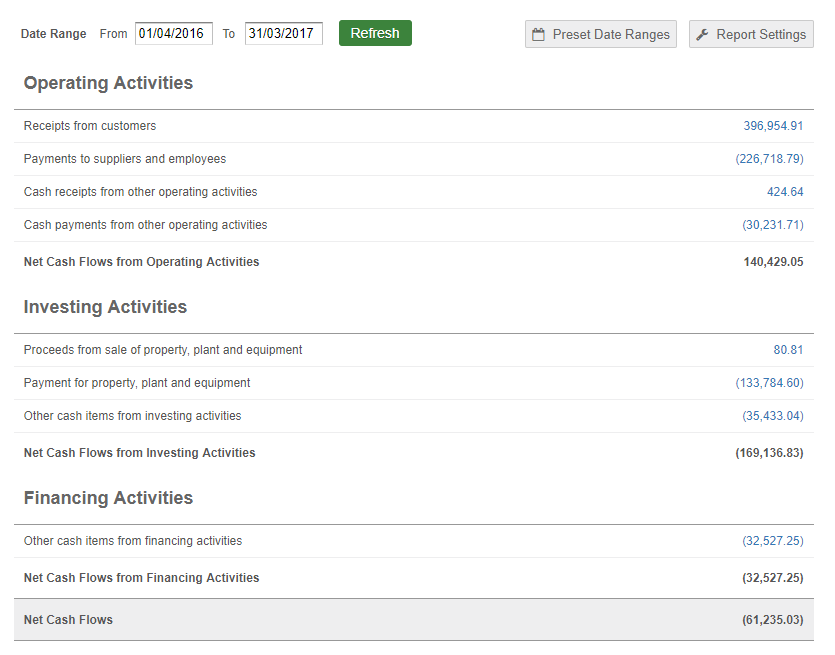

The Cash Flow Statement is divided up into 3 sections.

Operating Activity shows the cash coming in and going out as a result of your main business activities. This will include things like income from sales invoices, payments against purchase invoices and staff wages.

Investing Activity shows cash expenditure used for purchasing assets in your business, this may include plant and machinery, office equipment or a company vehicle. Disposal of such assets will also increase the cash in this section.

Finance Activity shows incoming cash from new loans as well as the routine repayments on existing loans. For limited companies a director may loan the company money to get things off the ground, these funds would appear here.

Customising your Report

We apply a loose mapping of nominal accounts to the various sections in the report, this should be suitable for most businesses. If however you would like to view or amend these mappings, you can do so from the “Report Settings” ![]() area.

area.

From here you can map individual nominal accounts or a nominal account range to specific categories within your Statement of Cash Flows. You can split debits and credits between two sections or allocate all transactions to the same list.

Please Note: To ensure the report remains consistent you should ensure that all codes on your Chart of Accounts are mapped to a corresponding category on your Statement of Cash Flows Report.

Cash and Cash Equivalent Accounts

The Statement of Cash Flows monitors the movements of cash across your Cash and Cash Equivalent accounts. These accounts are typically represented as bank accounts (excluding long term loans) with cash deposits or deposits that can easily be converted to cash.

In your Report Settings area we allow you to define which accounts should be considered as Cash or Cash Equivalent. When you run your first report, we will automatically assign any current, savings, petty cash, credit card and merchant accounts to this list. If you wish you can then remove or add additional accounts to this list.